Repair, Don’t Replace: Why the U.S. Smartphone Repair Market Is Gaining Momentum

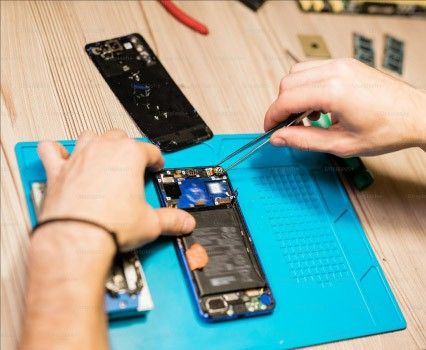

As smartphones become more advanced and more expensive, the US smartphone repair market is emerging as a significant, rapidly growing industry. According to recent data, this sector is booming, driven by both consumer behavior and shifting service models.

A Market on Rise

In 2024, the US smartphone repair industry was valued at approximately USD 5,036 million and is projected to reach USD 8,373 million by 2030, with a CAGR of 9.1%, underscoring its rapid expansion and growing importance to stakeholders.

What’s Fueling the Growth?

Several key trends are playing an essential role in fueling this growth:

• Third-party repair services are dominant: independent repair providers now account for over 60% of smartphone repairs, surpassing traditional OEM-authorized service sectors. Shops like uBreakiFix, CPR Cell Phone Repair, and iCracked offer fast, affordable repairs accessible for even on-demand mobile maintenance.

• Diverse Revenue Models: This industry is diversifying beyond pay-per-repair. Now subscription and warranty-based plans are gaining ground, especially among customers who own premium smartphones. These models help providers secure recurring revenue and perform more straightforward repairs for more predictable problems.

• Rising Device Complexity: As smartphones have become more advanced, with features such as foldable displays, multiple cameras, and high-capacity batteries, the need for specialized repair services is increasing. These third-party shops are investing in skilled technicians and advanced diagnostics to meet this demand for advanced service.

Breakdown by Repair Type

Not all repairs contribute equally; here’s how different types, such as screen replacements and battery repairs, drive the overall market and reflect consumer priorities in device maintenance.

• Screen replacements, accounting for about 42% of repair demand, constitute the largest segment, underscoring the critical role of display repairs in the market.

• Battery Replacement: This follows at 18%, which is primarily due to an aging device and intensive use, which cause deterioration of the mobile battery.

• The remaining repairs include charging port repairs, camera replacements, water-damage repairs, software/firmware issues, speaker/microphone issues, and other component repairs.

This mix of repairs across components reflects how consumers keep their devices working, not just by fixing broken screens but also by addressing common technical and physical issues.

Pricing Landscape

The repair costs vary significantly, primarily based on model types, fault types, and service channels:

• Screen repairs, which dominate the repair sector, typically range between $120 and $350, especially for premium phone models with OLED displays or foldable screens.

• Battery Changes usually cost from $60-$120

• Repairs for other parts, like pots, camera damage, or water damage, fall in the range of $50-$200

• On-demand phone services may cost more for home visits or for faster turnaround, but they offer unmatched convenience.

Meanwhile, warranty and subscription plans, which typically cost $100 to $200 annually, are gaining popularity among users who want multiple repairs covered under a predictable cost structure.

Regional Drivers

States like Texas, California, and Florida are key regional drivers, with Texas leading at 13% of repair revenue due to dense urban populations and numerous repair shops.

• Due to its large urban population and a strong presence of third-party repair shops, Texas leads the US in repair revenue, accounting for about 13% of the total.

• California accounts for 12% of repair revenue, boosted by high smartphone adoption in significant cities and favorable legislation for the ‘right to repair'.

• Florida accounted for about 9% of the market, mainly benefiting from a mix of urban dwellers, retirees, and tourists who demand faster, affordable mobile repairs.

These states combine high device usage with dense populations and a supportive regulatory environment, making them a hotbed for repair and innovation, with service expansion.

Challenges and Opportunities

|

Challenges |

Opportunities |

| Limited access to genuine parts for third-party repair providers affects repair quality and consistency. | Growing acceptance of Right to Repair legislation, increasing access to official parts, and repair documentation. |

| Increasing device complexity (foldable screens, multi-camera modules, tightly integrated components) requires specialized tools and skills. | Rising demand for subscription-based and warranty repair plans is creating predictable revenue streams for repair businesses. |

| There is a wide variation in repair pricing across regions, leading to inconsistent affordability. | Expansion of on-demand and mobile repair services that offer convenience and can reach underserved locations. |

| Reliance on OEM restrictions can limit third-party repair capabilities. | Substantial consumer shift toward sustainability and e-waste reduction, encouraging more customers to repair rather than replace devices. |

| Difficulty maintaining standardized service quality across independent repair shops. |

Growing market size and device dependency are increasing the long-term customer base for repair providers. |

Why This Matters

For providers of mobile repair services, this growth potential presents a significant opportunity. The combination of increased device complexity, customer demand for convenience, and emerging business models such as subscription plans gives these third-party shops a strong runway for scaling. On the consumer side, repairing phones instead of replacing them is not only an economically wise decision but is seen as a responsible decision. As repairs have become more accessible, affordable, and flexible, more users are likely to extend the life of their devices.