China’s Biochar Market: A Rising Wave in Sustainable Agriculture and Carbon Strategy

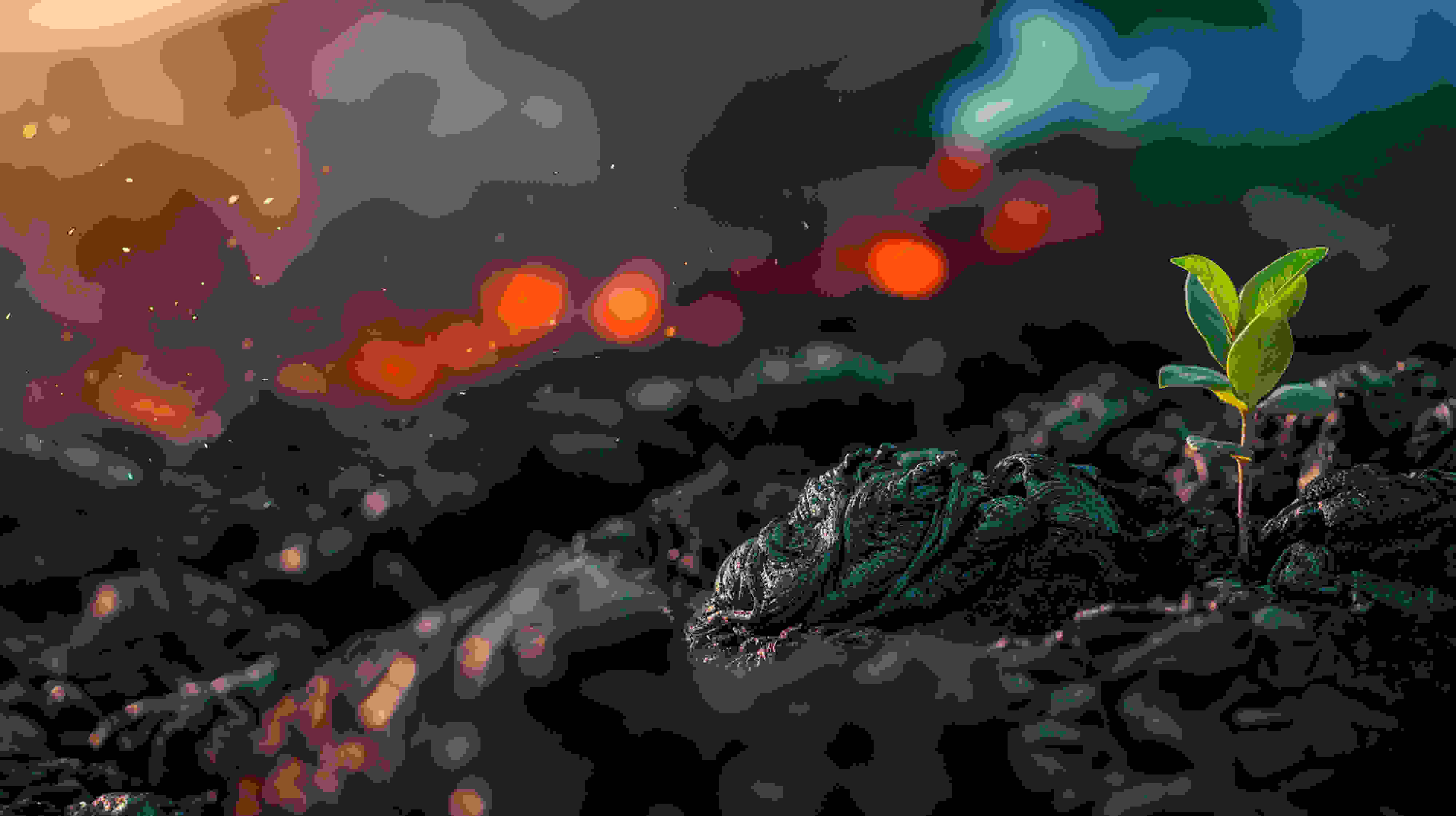

As China advances decisively toward environmental sustainability & carbon-neutrality goals, the biochar market, which is a stable, carbon-rich soil amendment made from biomass, is gaining significant traction. In 2023, biochar consumption in China reached 711,674 tons, and demand is expected to more than double by 2030 to 1,525,962 tons, growing at a robust CAGR of 11.7%. This rapid growth is driven by increasing demand for soil improvement, waste biomass utilization, environmental cleanup, and support for national carbon sequestration goals. As agriculture modernizes and the emphasis on sustainable practices increases, biochar is emerging as a versatile and practical solution not just for improving crop yields but also for the circular economy and environmental objectives.

Market Size and Growth: What’s Fueling the Surge

The expansion of China’s biochar market reflects several converging forces:

- Sustainability and carbon-neutrality goals: Biochar provides a scalable method to trap carbon and lessen the environmental impact of agricultural waste, supporting China's commitment to cutting greenhouse gas emissions and reaching carbon neutrality.

- Agriculture and waste-management dynamics: Large quantities of agricultural residues, such as straw, husks, crop by-products, and other biomass (wood, manure, industrial by-products), provide sufficient feedstock for biochar production.

- Economic and production efficiencies: As pyrolysis and other production methods advance, efficiencies improve, making biochar more affordable and accessible.

The result is a doubling of market volume in less than a decade, establishing biochar as a significant growth sector in China’s green economy transition.

Feedstock Mix: Where Biochar Comes From

Biochar production in China uses various biomass sources. The breakdown by feedstock shows:

| Feedstock Type | Share of Market |

| Agricultural waste (crop residues, husks, straw, etc.) | 45% |

| Woody biomass (sawdust, wood chips, bark) | 25% |

| Animal manure (poultry, cattle, pig manure) | 20% |

| Other biomass (industrial by-products, municipal organic waste, etc.) | 10% |

Using agricultural waste as the dominant feedstock underscores how biochar production helps address existing waste challenges by turning crop residues into a value-added oil amendment rather than letting them go to waste or be burned. Woody biomass and manure add diversity and quality, while the other biomass helps promote circular-economy use of industrial and urban organic waste.

Technology & Product Evolution: Pyrolysis Leads the Way

In terms of production technology, pyrolysis remains the leading method, valued for its versatility, scalability, and compatibility with various feedstocks. Pyrolysis-derived biochar supports multiple uses, including soil improvement, crop yield enhancement, environmental cleanup, and carbon storage. Other technologies, such as gasification and hydrothermal carbonization, also exist, with growth mainly possible in markets where feedstock type or application requirements differ (for example, high-moisture biomass or waste-to-energy applications). Additionally, product qualities such as nutrient-rich or pelletized biochar are becoming more common, especially for high-end agricultural uses and soil conditioning.

Price Trends: From Volatility to Value Differentiation

The price trend of biochar in China shows a dynamic balance of supply, demand, production costs, and product quality.

- In 2020, the average price was ~ USD 400 per ton.

- Prices rose to ~ USD 430 per ton by 2022, driven by higher demand from agriculture and environmental uses as biochar gained popularity.

- By 2023, prices returned to around USD 400 per ton as feedstock supply stabilized and more producers entered the market.

- Between 2024 and 2025, prices further declined to approximately USD 350–370 per ton, indicating improved efficiency and increased competition.

- Starting in 2026, a rebound is anticipated, with prices around USD 380 per ton in 2026 and USD 420 per ton in 2027, driven by demand for higher-quality, premium biochar (nutrient-enhanced, pelletized, and eligible for carbon credits).

- After 2027, a modest correction is forecasted, ending around USD 360 per ton by 2030, driven by market maturation, feedstock stability, and competitive pricing strategies.

This pricing arc ranges from early demand-driven increases to mid-cycle stabilization, followed by quality-driven Premiumization, indicating a maturing market that values both cost and performance.

Trends Shaping the Market: Sustainability, Soil Health & Carbon Focus

Several trends are redefining how biochar is viewed and used in China:

- From waste to value: Agricultural residues and biomass that were once burned or discarded are now being transformed into valuable soil amendments that enhance soil fertility and decrease environmental impacts.

- Sustainable agriculture adoption: Biochar is increasingly embraced not only for yield improvement but also for long-term soil health, water retention, nutrient retention, soil structure, and reducing reliance on chemical fertilizers.

- Carbon sequestration and environmental goals: As China pursues carbon neutrality and a circular economy, biochar offers dual advantages: enhancing soil health and locking in carbon in the long term. This makes it appealing for ecological policies, carbon-credit programs, and sustainable farming efforts.

- Product and quality differentiation: There is a growing demand for premium, pelletized biochar that is nutrient-enriched or optimized for specific soil or environmental needs. This allows producers to command higher margins and encourages investment in technology and quality control.

- Diverse feedstock use enhances resilience: Relying on a mix of agricultural waste, wood, manure, and industrial by-products makes biochar production more resistant to fluctuations in any single resource and supports circular economy goals.

Opportunities for Investors, Producers, and Agricultural Stakeholders.

Given the trajectory and structural dynamics, the biochar market in China offers several compelling opportunities:

- Scaling production with plentiful agricultural waste: By utilizing crop residues, which are abundant and often underused, the biochar provides a cost-effective and scalable feedstock source.

- Investing in high-quality, unique biochar: Premium biochar, which is nutrient-rich, pelletized, and eligible for carbon credits, appeals to stakeholders focused on soil health and sustainability.

- Aligning with policy and carbon markets: As national carbon-neutrality goals become prominent, biochar provides a credible pathway for carbon sequestration, opening opportunities for policy support, carbon credits, and environmental compliance.

- Targeting sustainable agriculture and rural development: Biochar adoption can enhance soil fertility, increase crop yields, and support sustainable farming practices, particularly in regions with degraded soil and intensive farming.

- Diversifying feedstock for resilience and circular-economy goals: Using a variety of waste streams, including agricultural residues, manures, woods, and industrial by-products, reduces reliance on any single resource and improves supply stability.

Conclusion

The biochar market in China is no longer niche; it is quickly becoming a key part of sustainable agriculture, waste management, and carbon sequestration efforts. With plentiful biomass resources, supportive environmental policies, advancing production technologies, and increasing demand for soil health and carbon reduction, biochar presents a strong growth opportunity.

For producers, investors, agricultural firms, and environmental technology stakeholders, now is the time to focus on scaling up production, investing in quality differentiation, and aligning with China’s long-term sustainability goals. This approach can unlock significant value and help create a greener, more resilient future.