Trying to Upgrade Your PC? Here’s Why RAM and SSD Cost More

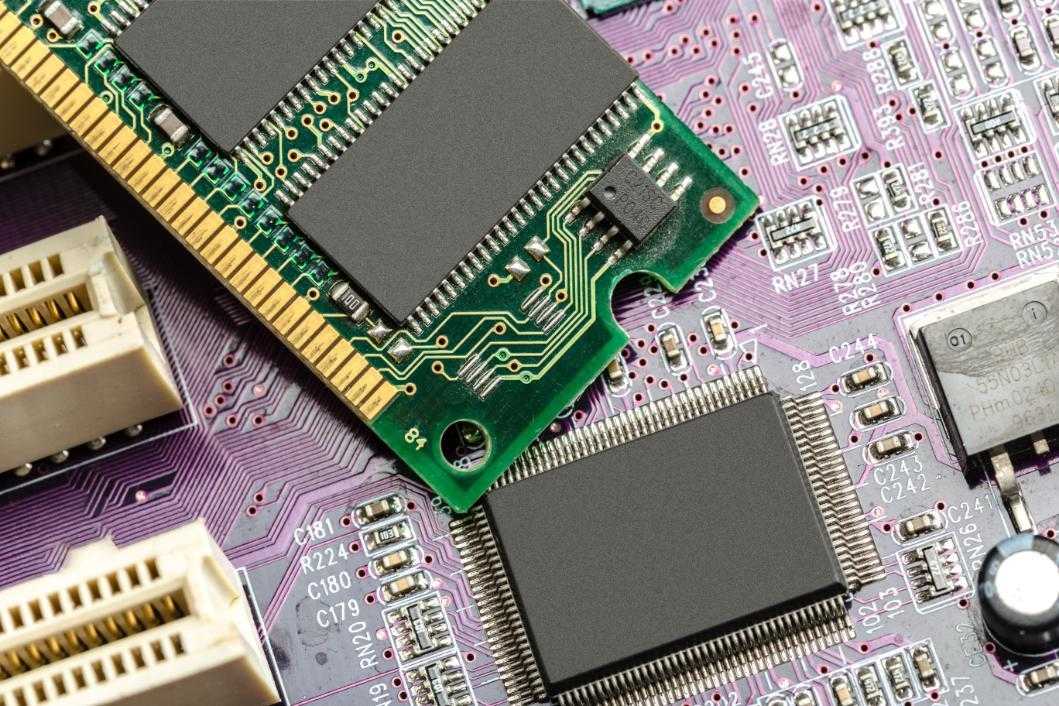

If you’ve tried upgrading your laptop or building a PC recently, chances are you’ve noticed something odd. RAM and SSDs, components that felt reasonably affordable the last time you checked, now cost significantly more. You’re not imagining it.

Prices for RAM and SSDs have risen sharply over the past year, and unlike earlier hardware spikes, this one isn’t driven by gamers, crypto miners, or a sudden wave of consumer upgrades. The cause is much bigger and far quieter.

Relatively inexpensive components just a year ago are now noticeably costlier, even though the products themselves haven’t changed. Price cycles are nothing new in the hardware world, but this rise feels different. It isn’t sudden or speculative, and it isn’t driven solely by consumer behavior. Instead, it reflects a more profound shift in how the global technology ecosystem allocates its resources.

Welcome to the AI-driven memory crunch.

Not long ago, upgrading to a decent SSD didn’t feel like a big decision. Prices were reasonable, storage capacities were increasing, and memory felt abundant. Fast forward to today, and those same products cost 30–50% more in many markets.

RAM hasn’t been spared either. Memory kits that once felt like a “cheap upgrade for later” are now prompting buyers to pause, rethink, or delay altogether.

What makes this price rise especially frustrating is that nothing fundamental has changed. There are no new features, no major generational leap, and just higher prices for the same hardware.

So what caused this?

At a basic level, RAM is your device’s short-term working memory. It helps browsers, apps, and programs run smoothly while you’re using them. SSDs, meanwhile, store everything permanently: the operating system, software, files, and photos. If RAM affects how responsive a system feels, SSDs influence how quickly it starts, loads, and saves.

Both are essential. And both are now caught in the same global supply squeeze.

While consumers were busy using AI tools for writing, coding, image generation, and automation, something far bigger was unfolding behind the scenes. Major technology companies are racing to build AI infrastructure at a scale never seen before. This has translated into massive data centers filled with thousands of servers, each packed with large amounts of memory and storage.

AI workloads are especially memory-intensive. Training and running large models require constant access to enormous datasets, which drives demand for DRAM and high-performance storage that can operate continuously without slowing. To secure this capacity, hyperscalers and cloud providers have been placing long-term, high-value orders for memory components.

Here’s the key detail: the same small group of companies that supply memory for consumer laptops and PCs also supply memory for these AI servers.

AI systems don’t rely on the same RAM modules you install in a home PC. They use high-bandwidth memory (HBM), an ultra-fast form of DRAM designed for AI accelerators. While the end products differ, the manufacturing ecosystem overlaps.

Memory production is also highly concentrated. Samsung, SK Hynix, and Micron together control roughly 90–95% of the global DRAM market and a similar share of NAND flash used in SSDs. When demand surges, there are very few alternative suppliers that can step in. These manufacturers operate under fixed constraints: limited wafer capacity, specialized fabrication lines, and finite engineering resources. When AI customers are willing to buy in bulk, sign multi-year contracts, and pay higher margins, it becomes commercially logical to prioritize them.

The result is that consumer-grade RAM and SSDs haven’t disappeared; they’ve just moved down the priority list.

This also isn’t a short-term imbalance that resolves in a quarter or two. Building new semiconductor fabrication facilities is slow, expensive, and technically complex. Even after billions of dollars in investment, new memory fabs typically take two to three years to deliver meaningful output.

At the same time, AI demand isn’t slowing down. If anything, it’s accelerating as more companies integrate AI into products, services, and internal operations. As a result, analysts expect memory supply tightness to persist well into the second half of the decade, keeping prices elevated compared to the ultra-cheap memory era consumers had grown accustomed to.

It’s tempting to compare this moment to the crypto mining boom, when GPU prices spiraled out of control. But there’s a crucial difference.

Crypto demand collapsed when profitability vanished. AI infrastructure, by contrast, is becoming foundational. Governments, enterprises, cloud providers, and software platforms are all making long-term investments in AI capacity. This demand isn’t speculative; it’s structural. That’s why memory manufacturers are reshaping their strategies around enterprise and AI customers, even scaling back or deprioritizing consumer-focused product lines in the process.

For consumers and small businesses, the takeaway is uncomfortable but clear. The era of endlessly falling RAM and SSD prices is over, at least for now. Waiting for a sudden crash may not pay off, and upgrades are better planned thoughtfully rather than postponed indefinitely. Prices may stabilize as new production capacity comes online and AI demand matures, but a rapid return to previous lows looks unlikely in the near term.

What we’re witnessing isn’t just a pricing issue; it’s a shift in how the digital economy allocates its most critical resources.

AI didn’t just change software. It quietly reshaped the hardware supply chain.

Until this wave stabilizes, the cost of memory, the foundation of modern computing, will continue to reflect this new reality. And for anyone building, upgrading, or budgeting for technology, understanding why prices look the way they do is far more helpful than hoping they suddenly fall.

No FAQs available at the moment.