Mexico Filter Media Market Set to Reach 190 Million Sq Meters by 2032 Amid Rising Industrialization

The Mexico filter media market is currently experiencing significant growth, driven by factors such as expanding industrialization, stringent environmental regulations, and a heightened emphasis on air and water quality. As of 2023, the market volume is recorded at 101 million square meters and is expected to reach 190 million square meters by 2032, reflecting a compound annual growth rate (CAGR) of 7.34% from 2025 to 2032. This growth signals Mexico’s progress towards sustainable industrial practices, with strong demand emerging from sectors including HVAC, automotive, water treatment, and industrial manufacturing.

In terms of filtration types, the market is divided into air filtration media and liquid filtration media. Air filtration media accounted for 53 million square meters in 2023, projected to grow to 93 million square meters by 2032, achieving a CAGR of 6.66%. Factors contributing to this rise include Mexico's urbanization, the increasing adoption of air purification systems, and rigorous workplace air quality standards. Conversely, liquid filtration media is experiencing even faster growth, expanding from 49 million square meters in 2023 to 97 million square meters by 2032, with a CAGR of 8.04%. This increase is driven primarily by growing demand within water treatment facilities, beverage manufacturing, and the oil and gas sector, where filtration systems are essential for enhancing water reuse and minimizing contaminants.

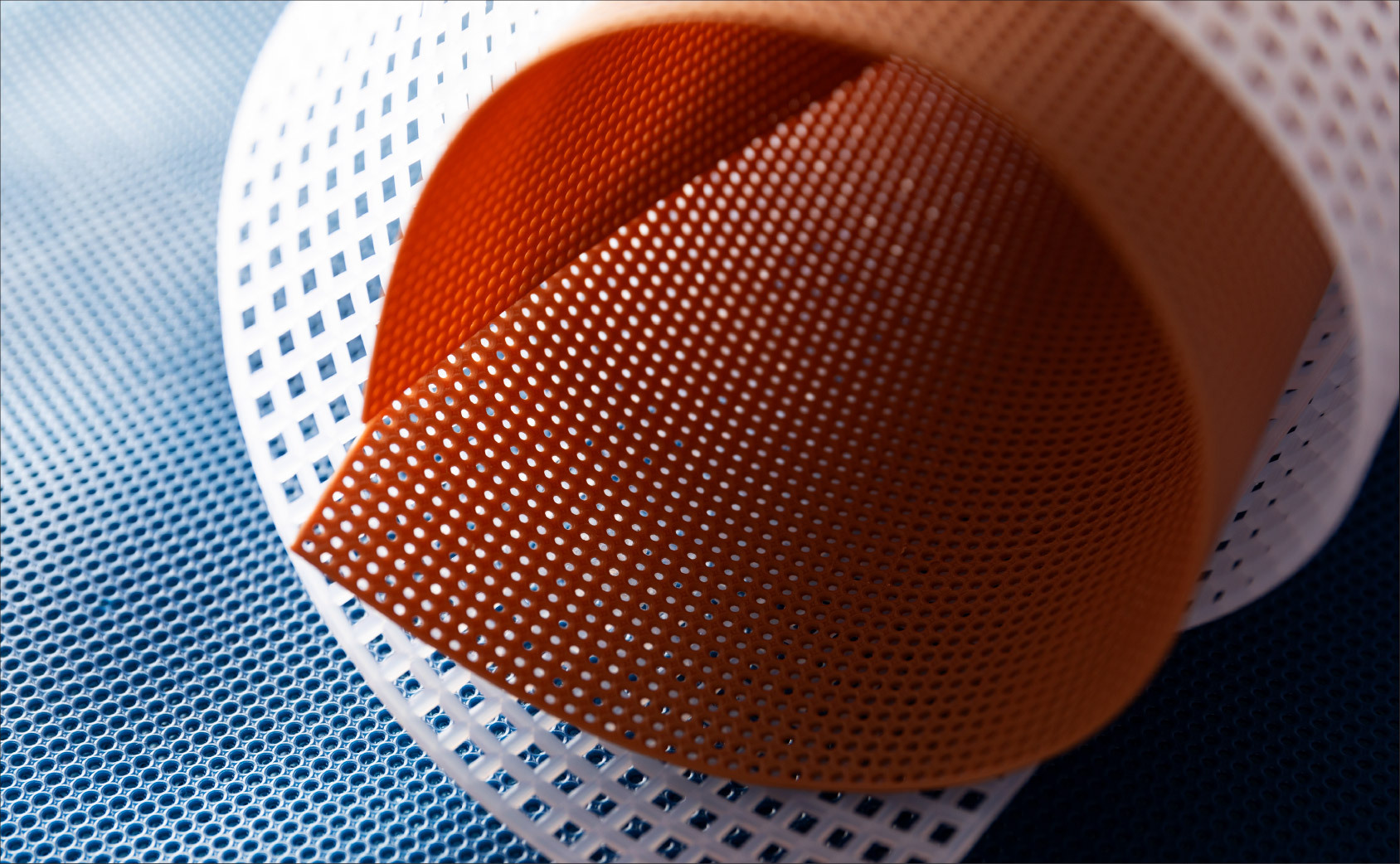

Regarding material format, woven fiber media dominates the market with 66 million square meters in 2023, expected to rise to 120 million square meters by 2032, reflecting a CAGR of 6.96%. These materials are preferred for their strength, reusability, and consistent performance in industrial filtration systems. Meanwhile, nonwoven fiber media, valued at 35 million square meters in 2023, is quickly gaining prominence, projected to grow to 70 million square meters by 2032, with a higher CAGR of 8.02%. The increasing adoption of nonwoven fibers can be attributed to their superior efficiency, cost-effectiveness, and adaptability to advanced filter designs, particularly in HVAC and water filtration applications.

Chemically, the market is shifting towards polymer-based materials that offer durability, chemical resistance, and versatility. Paper-based media currently holds a smaller market share, projected to grow moderately from 33 million square meters in 2023 to 52 million square meters by 2032, with a CAGR of 5.06%, mainly catering to low-cost residential and automotive applications. Polymer-based media represents the largest and fastest-growing category, increasing from 58 million square meters to 121 million square meters, with a robust CAGR of 8.66%. Within this segment, polypropylene (PP) demonstrates the highest growth rate of 9.72%, expected to reach 46 million square meters by 2032, supported by its lightweight, affordability, and high filtration efficiency. Following PP, polyethylene terephthalate (PET) achieves an 8.37% CAGR, while polyamide (PA) and other polymers exhibit stable growth. Metal-based media, primarily used in environments with high temperatures and corrosive conditions, is steadily expanding from 10 million to 17 million square meters at a 6.08% CAGR, indicative of consistent industrial application in the petrochemical and energy sectors.

In terms of end-use industries, the residential HVAC and air purification sectors lead the market with 21 million square meters in 2023, projected to reach 37 million square meters by 2032, representing a CAGR of 6.56%. This growth is linked to an increasing awareness of indoor air quality and the rising installation of filtration-equipped air conditioners and purifiers in urban residences. The building and commercial HVAC sector follows, estimated to climb from 20 million to 38 million square meters, with a 7.24% CAGR, backed by the development of modern infrastructure and commercial real estate in Mexico’s cities.

The automotive filtration segment, which includes cabin air, fuel, and oil filters, plays a significant role, growing from 17 million to 29 million square meters at a 6.24% CAGR, driven by Mexico’s strong automotive manufacturing industry. Industrial process filtration is also expanding robustly, expected to increase from 15 million to 31 million square meters at a CAGR of 8.24%, supported by industrial diversification and stricter environmental standards in food processing, chemicals, and electronics manufacturing.

The water and wastewater filtration segment stands out as one of the fastest-growing categories, advancing from 20 million to 41 million square meters at a CAGR of 8.16%. This growth is fueled by increasing investments in water treatment infrastructure due to drought conditions and water scarcity, prompting industries to adopt filtration-based water reuse systems. Other specialized applications, including pharmaceuticals, food and beverage, and energy production, are also projected to grow from 7 million to 14 million square meters at a 7.99% CAGR, reflecting ongoing technological innovation and heightened hygiene requirements in manufacturing environments.