From Pandemic Shock to Strategic Expansion: Production Volumes, CAPEX, and Pricing Trends in Japan's Carbon Fiber Market (2020-2024 Analysis)

The Japan Carbon Fiber Market exemplifies the peak of a sophisticated and high-value advanced materials industry, marked by technological leadership, strategic vertical integration, and significant influence on global supply chains. As the foremost producer globally, Japan commands approximately 50-60% of the global carbon fiber capacity, establishing its dominance through continuous innovation and stringent quality control rather than on commodity pricing.

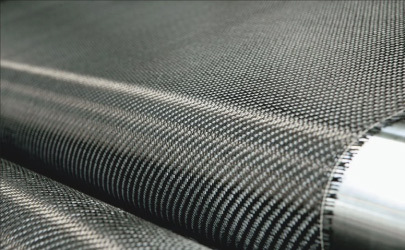

The market operates as an oligopoly, primarily governed by three fully integrated chemical conglomerates: Toray Industries, recognized as the global leader; Teijin Limited, a major player in advanced composites; and Mitsubishi Chemical Group, known for its industrial-scale production capabilities. This concentration facilitates coordinated, capital-intensive long-term strategies but also ties the sector's health closely to the fortunes and R&D endeavors of these dominant firms. Their business models encompass more than just selling raw fiber; they have mastered the complete value chain from precursor (PAN) manufacturing to intermediate materials such as prepreg and woven fabrics allowing them to maximize value and integrate their products into customer project designs, especially within the aerospace sector. This deep integration forms a substantial barrier to entry and is crucial for Japan's sustained leadership.

The market's application portfolio indicates a strategic emphasis on high-performance and high-margin sectors, resulting in a unique distribution of value. Aerospace and Defense are pivotal, accounting for over 40% of market value, where Japanese intermediate and high-modulus fibers are certified for primary structures in aircraft for Boeing and Airbus. While this segment offers excellent margins, it also presents cyclical vulnerabilities. In contrast, Industrial Applications including wind turbine blades and pressure vesselsdrive the largest volume, facilitating essential scale and manufacturing stability. However, the most dynamic growth areas lie in Automotive & Transportation and Energy. Japan's national hydrogen strategy is driving unprecedented demand for Type III/IV pressure vessels, thereby transforming the energy segment from a niche market into a critical focus. Additionally, the shift towards electric and fuel cell vehicles is expanding carbon fiber use beyond supercars into structural battery enclosures and chassis components, addressing key range and efficiency challenges.

On the production and pricing front, the market has faced considerable turbulence. The aerospace downturn triggered by the pandemic in 2020-2021 led to a temporary supply surplus, but a subsequent recovery combined with global energy inflation and disrupted supply chains drove prices to peak levels. Current pricing trends suggest a gradual stabilization and slight softening as new global capacity becomes available and production scales. The underlying production metrics indicate a resilient upward trajectory, with major Japanese players implementing multi-year CAPEX programs aimed at optimizing existing lines and establishing new capacity specifically for large-tow industrial fibers to support the energy transition. This investment strategy is twofold: increasing volume for industrial growth while simultaneously advancing cutting-edge fiber technology for aerospace, thereby maintaining leadership across both fronts.

However, this leadership faces growing challenges. The high cost of carbon fiber presents a significant barrier to mass-market adoption, limiting its usage primarily to premium applications. Furthermore, fierce competition is arising from well-funded firms in China, South Korea, and Europe, which are rapidly enhancing quality and pursuing aggressive pricing strategies in industrial segments. The industry's environmental impact is also under scrutiny; the energy-intensive production processes and the lack of mature, economical recycling pathways for composite waste pose substantial sustainability challenges that need addressing to align with global circular economy initiatives.

Looking ahead, the future of the Japan carbon fiber market will depend on its capacity to manage a strategic duality. First, it must safeguard its high-margin position in aerospace and specialty materials through ongoing innovations in fiber performance and advanced intermediate forms. Second, it must address cost efficiencies to succeed in the larger high-volume markets of automotive and clean energy. Achieving breakthroughs in high-speed manufacturing, precursor efficiency, and the commercialization of recycled carbon fiber is essential.

Success in these domains will enable Japan to transition from being merely a supplier of premium materials to an indispensable contributor to global carbon neutrality, providing lightweight solutions essential for sustainable mobility, renewable energy, and effective infrastructure. Thus, the evolution of the market will represent not just a shift in production volumes but a strategic endeavor to lower the cost-per-performance metric, ensuring Japanese carbon fiber remains the material of choice for addressing the engineering challenges of the 21st century.