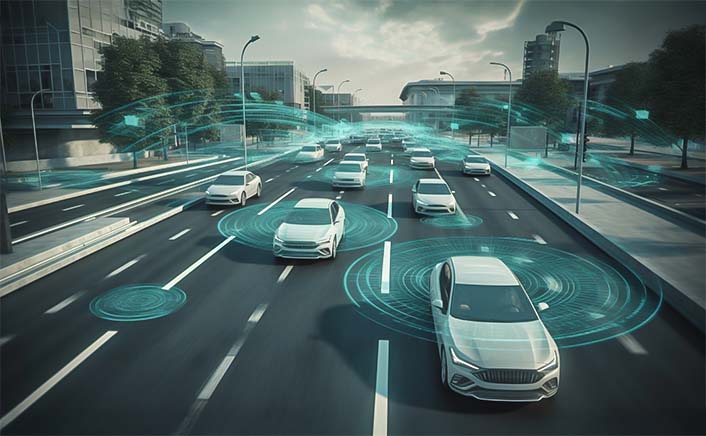

Commercial Fleets Driving V2V Adoption in India: Enhancing Operational Efficiency and Road Safety

The India Vehicle-to-Vehicle (V2V) Communication Market is currently experiencing significant growth, driven by the broader trends of connected mobility, advanced transportation systems, and the enhancement of road safety measures. The market is primarily divided between passenger vehicles, which make up 60%, and commercial vehicles—such as light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and buses—that constitute the remaining 40%. This division underscores the importance of both consumer-driven adoption trends and the critical role of commercial fleets in shaping the V2V landscape in India.

Passenger vehicles lead the V2V market due to several compelling factors. Increasing regulatory pressures, such as those from Bharat NCAP, promote the integration of advanced safety features, including collision avoidance, lane departure warning, and blind spot detection. V2V communication enhances these features by enabling real-time data exchange between vehicles, alerting drivers to potential hazards, and facilitating semi-automated interventions. This connection directly contributes to improved safety ratings. Moreover, urban consumers are becoming increasingly aware of road safety and connected technologies, which has expedited the adoption of V2V systems. High traffic density in major metropolitan areas such as Delhi, Mumbai, Bengaluru, and Hyderabad has created a demand for systems capable of anticipating collisions, managing lane changes, and providing traffic alerts, making V2V a valuable proposition for everyday drivers. The rise of electric vehicles (EVs) under FAME-III incentives also presents an opportunity for manufacturers to incorporate V2V technology from the outset, ensuring that these vehicles are both connected and safety-compliant from day one. Additionally, automotive manufacturers are appealing to tech-savvy millennials and urban buyers with modern EV designs and advanced connectivity solutions that enrich the driving experience.

Conversely, commercial vehicles, which account for 40% of the market, present a strategic segment for V2V adoption. Fleet operators, logistics companies, and public transport providers encounter substantial operational and safety challenges, particularly on highways and congested roads. V2V technology enables commercial fleets to implement cooperative driving, platooning, and real-time traffic management, thereby improving both road safety and operational efficiency. For example, heavy trucks outfitted with V2V modules can share information about braking patterns, speed changes, and positional data with following vehicles, effectively reducing the risk of rear-end collisions—a prevalent issue in India’s trucking industry. Buses and last-mile transport vehicles also benefit from V2V-enabled warning systems for pedestrians, prioritization of emergency vehicles, and blind-spot alerts, all of which are vital for public safety. Government initiatives under the Smart Cities Mission, such as intelligent traffic systems and connected transport corridors, facilitate the integration of V2V technology in commercial vehicles, fostering increased adoption in structured fleet operations.

The distinction between passenger and commercial vehicle adoption further impacts market dynamics, pricing strategies, and deployment models. While passenger vehicles typically adopt OEM-integrated V2V systems that bundle safety and infotainment features to attract individual buyers, commercial fleets often utilize aftermarket or retrofit solutions. These allow older vehicles to be equipped with V2V modules, ensuring fleet-wide safety compliance and efficiency without needing to replace entire fleets. Additionally, commercial applications prioritize durability, reliability, and interoperability, as various vehicle types operate within the same transport corridors, whereas passenger vehicles tend to focus on convenience, user experience, and connectivity features.

Looking ahead, the V2V market in India is poised to benefit from a combination of regulatory support, technological advancements, and increasing consumer awareness. As vehicle density rises and autonomous vehicle technology continues to evolve, both the passenger and commercial segments will increasingly rely on real-time vehicular communication to prevent accidents, optimize traffic flow, and improve mobility efficiency. The current 60:40 split reflects existing adoption patterns, but the rapid growth of electric and connected commercial fleets, especially in logistics and public transport, may lead to a greater share of commercial vehicles over the next decade. In conclusion, the India V2V communication market is primarily driven by passenger vehicle demand while being strategically influenced by the adoption of commercial fleets, establishing a balanced growth trajectory that positions India as a key market for connected vehicle technologies in Asia.