Why Diesel Still Leads and Electric Is Rising in the GCC Drilling Services Market

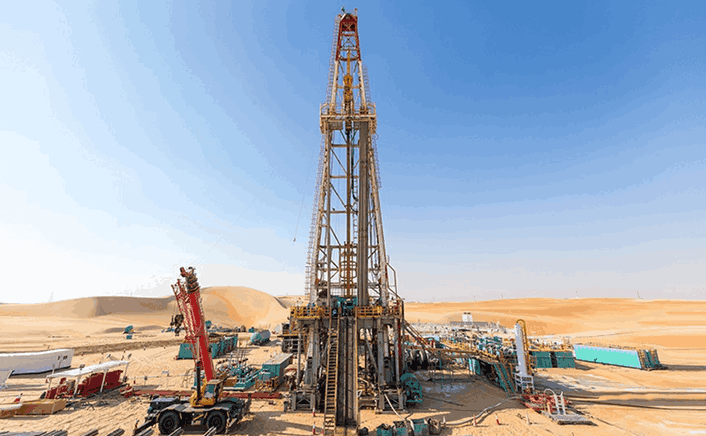

The GCC Drilling Services Market exhibits clear segmentation by power source, mirroring the region’s operating environments, energy infrastructure, cost factors, and shifting sustainability priorities. Currently, diesel-powered drilling machines lead the market, holding the largest share due to their reliability, mobility, and capability to function in remote and challenging locations. Many drilling sites within the GCC, especially onshore oil and gas fields and exploratory areas, often lack stable access to grid power, making diesel-powered rigs the most feasible choice. Their established performance under extreme temperatures, ease of refueling, and compatibility with existing fleets further bolster their widespread use across Saudi Arabia, Kuwait, and Oman.

Diesel-powered rigs also benefit from robust aftermarket support and well-established maintenance ecosystems in the GCC drilling services sector. Service providers have extensive operational experience with diesel engines, enabling quick deployment and minimizing operational risks. Additionally, the initial capital expense for diesel-powered drilling machines is typically lower than that of electric alternatives, which supports their utilization in cost-sensitive projects and short-term drilling campaigns. However, rising fuel prices, emissions concerns, and stricter environmental regulations are gradually influencing operator preferences, particularly for long-duration and high-activity drilling operations.

Electric-powered drilling machines are gaining traction as the second-largest segment in the GCC drilling services market, driven by an increased emphasis on efficiency, emissions reduction, and digital integration. Electric rigs provide lower operating costs throughout the project lifecycle, especially in areas with access to grid power or hybrid power systems. They offer improved energy efficiency, reduced noise levels, and lower carbon emissions compared to their diesel counterparts. In countries such as the United Arab Emirates and Saudi Arabia, investments in power infrastructure and smart oilfield initiatives are facilitating the adoption of electric drilling systems, particularly for large-scale, long-term development projects.

The transition toward electric-powered drilling machines aligns with national sustainability agendas and net-zero objectives across the GCC. Electric rigs can more readily integrate with advanced automation, real-time monitoring, and digital drilling technologies, enhancing operational control and drilling accuracy. These benefits are particularly advantageous in complex wells and high-density drilling programs, where optimizing performance and reducing downtime significantly improve project economics. Although higher upfront costs and infrastructure needs present challenges, the long-term cost and environmental benefits are driving gradual adoption.

Hydraulic drilling machines, while representing a smaller segment, hold strategic importance within the GCC drilling services market. Typically employed in specialized applications such as geotechnical drilling, water well drilling, and certain construction and infrastructure projects, hydraulic systems offer precise control, high torque output, and adaptability to diverse drilling conditions. Their compact design and flexibility make them suitable for urban or space-constrained environments, where larger diesel or electric rigs may not be practical.

Despite accounting for a smaller market share, the demand for hydraulic drilling machines is expected to remain stable, bolstered by ongoing infrastructure development and environmental assessment activities across the GCC. As governments continue to invest in transportation, urban development, and sustainability initiatives, hydraulic drilling services will play a pivotal role in the broader drilling ecosystem.

In summary, the power source segmentation of the GCC drilling services market indicates a gradual transition rather than an abrupt shift. Diesel-powered drilling machines are poised to maintain dominance in the short term due to their operational practicality, while electric-powered solutions are steadily gaining market share as infrastructure, regulatory, and sustainability factors strengthen. Hydraulic drilling machines will continue to serve niche but essential roles, contributing to a balanced and evolving market structure.