The Bale Unroller Buying Pyramid: Volume, Core, and Premium Tiers

The Bale Unroller Market is distinctly divided by price, indicative of significant variations in farm scale, operational intensity, and purchasing rationale. The Economy Segment (priced under $5,000) holds an impressive 67% share of global unit sales, establishing itself as the predominant volume base of the market. This dominance stems from the global farm structure, where small and medium-sized holdings substantially outnumber larger industrial operations. Demand within this segment is primarily fueled by the need for basic mechanization to replace manual labor, with purchasing decisions heavily influenced by the initial price and compatibility with existing equipment.

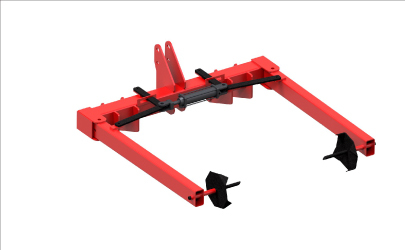

Products in this category are generally straightforward, mechanically-driven 3-point hitch unrollers with limited features, competing mainly on cost, dealer accessibility, and reliability. Manufacturers such as Worksaver and budget lines from H&S Manufacturing thrive in this space through optimized production for scale and expansive dealer networks aimed at reaching a fragmented customer base. Nonetheless, this segment faces the thinnest profit margins, high sensitivity to fluctuations in farm income, and fierce competition from low-cost imports, especially in emerging markets. While it continues to hold a dominant volume share, erosion is anticipated as farm consolidation reduces the number of small units and inflationary pressures push even basic models into the lower range of the Mid-Range segment.

Conversely, the Mid-Range Segment (priced between $5,000 and $25,000), which accounts for 25% of unit sales, is the competitive core for full-time livestock producers. This segment captures a crucial transition from being perceived as a "cost-saving tool" to a "productivity-enhancing asset." Buyers in this tier are professional farmers with substantial herds evaluating factors like the total cost of ownership, durability, and specific performance features such as adjustable spread widths and heavier-duty construction.

The Mid-Range is a fiercely contested arena, showcasing flagship models from market leaders like H&S Manufacturing and advanced offerings from regional specialists such as Wessex and Hustler Equipment. Additionally, major brands like John Deere participate by leveraging their established brand equity and packaged financing options. The Mid-Range segment is strategically critical as it generates significantly higher revenue per unit than the Economy tier and serves as a proving ground for new features before they either trickle down to the lower segment or expand upwards. Growth in this segment is closely linked to the economic health of commercial family farms, serving as an essential indicator of confidence in agricultural capital investment.

The Premium Segment (priced over $25,000), although accounting for the smallest unit share at 8%, is recognized as the hub of innovation and high-margin value within the market. This segment encompasses large, trailed bale processors that often integrate unrolling, chopping, and weighing functions, specifically designed to meet the relentless demands of mega-dairies and large-scale feedlots. Brands such as Vermeer and McHale are prominent in this category, competing based on engineering excellence, uptime, and after-sales service rather than price.

Purchases within this segment represent strategic capital investments, typically justified through sophisticated return on investment calculations that consider labor savings, feed efficiency, and economies of scale.

The Premium segment is also the first to adopt advanced technologies, including integrated weighing systems, moisture sensors, and data connectivity to herd management software. Consequently, while small in terms of volume, the Premium segment contributes around 25-35% of overall market revenue and significantly influences the technological direction of the entire industry. Its growth correlates directly with global trends toward livestock consolidation and the expansion of confined animal feeding operations (CAFOs).

The relationship between these segments shapes the competitive dynamics of the market. A pronounced "barbell" effect is evident, with substantial volume at the low end (Economy) and significant value at the high end (Premium), while the Mid-Range functions as a critical, dynamic, and highly competitive bridge.

Future trends appear to suggest a gradual movement toward premiumization, where features from the Premium segment (such as basic automation and improved durability) become standard expectations in the Mid-Range. Additionally, inflationary pressures are likely to push the simplest models out of the Economy segment.

For manufacturers, adopting a clear, segment-specific strategy is vital: excelling in the Economy tier necessitates operational efficiency and cost leadership, while success in the Mid-Range requires a compelling value proposition and robust dealer partnerships. Leading the Premium tier demands ongoing innovation and a solution-oriented relationship with large-scale agricultural enterprises. Therefore, understanding this price-based market segmentation is critical for strategic positioning, product development, and market entry plans within the global bale unroller industry.