Truck & Bus Bias Tyre Market: Why a Traditional Tyre Technology Still Powers Global Transport

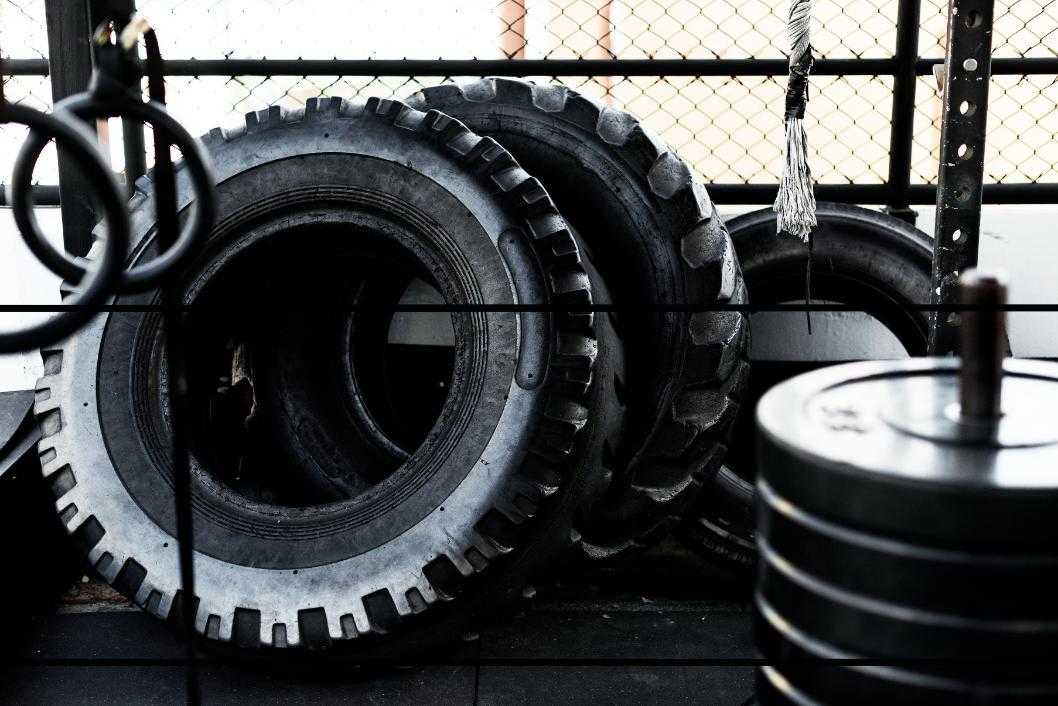

In a world where industry discussions are often centered on radial tires, The Truck and Bus Bias Tire Market demonstrates notable growth and resilience. The global market was valued at over USD 8.20 million in 2023 and continues to grow steadily, expected to reach USD 10.40 million by 2030 with a CAGR of 3.40%. The primary driver of this growth is not technological stagnation but the enduring use of bias tires, especially in commercial settings where strength, affordability, and reliability are prioritized over advanced design. In many regions, particularly emerging markets where construction, freight transport, and off-road mobility are vital to economic activity, bias tires remain essential. Their cross-ply construction and reinforced sidewalls enable them to handle rugged surfaces, heavy loads, and inconsistent road conditions—scenarios where radial tires may perform less effectively or be more costly to maintain.

Growth Momentum Rooted in Practical Needs

One of the clearest signs of ongoing market relevance is the dominance of the replacement segment, which makes up 64% of total demand. This indicates tough conditions in key regions and the vital role commercial fleets have in daily logistics. Bias tires wear out faster in more demanding environments, but their lower initial cost and easy maintenance make them the preferred option for budget-conscious operators.

The market structure by product type further highlights where operators place value. Steer tires account for over 55% of the market share, driven by their high replacement frequency and their essential role in vehicle control and balance.

Trucks, which alone make up more than 70% of the market, are the workhorses of freight and industrial transport, reinforcing the ongoing demand for tires that can endure long hours, heavy loads, and unpredictable terrain.

A Market Shaped by Roads, Fleets, and Operating Realities

Commercial vehicle OEMs remain a primary demand driver, accounting for over 60% of total tyre consumption. However, the relationship between OEM and replacement demand reveals a more profound insight: while fleet owners prioritize the reliability of OEM-fitted tyres, long-term revenue largely depends on repeat purchases driven by ongoing wear. Bias tyres are especially significant in sectors like mining, agriculture, construction, and long-haul freight, where consistent tyre replacement isn’t viewed as a setback but as a predictable operating cost. The market’s structure shows that durability doesn’t necessarily mean longevity; instead, it reflects the ability to perform reliably under stress, even if frequent replacements are required. In terms of applications, heavy-regular tyres hold over 45% of the market share, indicating that core freight movement, rather than a niche or specialized activity, continues to anchor the industry. Additionally, mixed-service tyres are gaining momentum as operators seek versatile options that perform reliably on both paved and uneven surfaces, providing a balanced solution for fleets operating across different terrains.

Asia-Pacific: The Market’s Centre of Gravity

The geographical distribution of demand provides additional insights into why biased tyres remain relevant. Asia Pacific accounts for over 65% of the global market, which is no coincidence. This region is experiencing rapid growth in transportation networks, significant construction activity, and some of the world’s largest commercial vehicle fleets. Road conditions vary widely, from smooth highways to rural soil, and broken surfaces in rural and industrial areas require tyres that emphasize toughness and cost efficiency.

Regions such as Latin America, the Middle East & Africa, and parts of Eastern Europe follow a similar pattern. These areas have a comparable operational relationship, where the affordability and durability of bias tires outweigh the potential advantages of more advanced options. Conversely, North America and Western Europe exhibit a more stable, application-specific demand, indicating that although radial tires dominate general transportation bias, tires still serve a meaningful niche where terrain and load characteristics require them.

Market Trends Reflecting Practical Innovation

Even though bias tires are based on older design principles, the market is evolving in noticeable ways. Manufacturers are increasingly focused on tread compounds engineered for high-heat resistance, especially for long-haul applications where heat buildup can impair performance. Advances in capacity also show a subtle trend of innovation within a segment often seen as mature. The larger trend, however, is in the market’s alignment with economic and infrastructural growth. As developing regions industrialize, demand for durable, affordable transportation solutions naturally rises, further supporting the role of bias tires. This connection between economic development and tire choice is the main reason the market continues to grow despite technological alternatives.

For investors and manufacturers, the opportunity lies not only in meeting high-volume demand but also in developing region-specific products tailored to terrain, climate, and vehicle usage patterns. Strengthening aftermarket networks where most demand originates further unlocks value, especially in high-growth regions.