Medical Fine Wire Market: The Micro-Engineered Backbone of Tomorrow’s Medical Devices

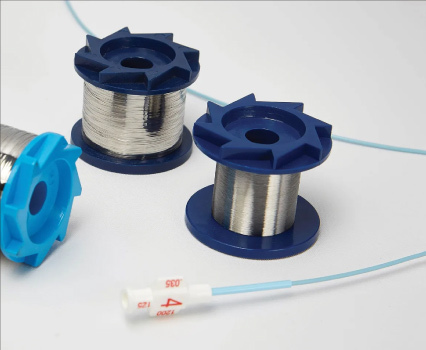

In healthcare, even the smallest component can have a significant impact. Medical fine wires are ultrathin, high-precision metal wires that often go unnoticed but play a crucial role in the industry. These wires are used in devices such as stents, catheters, guidewires, pacemakers, and minimally invasive surgical tools, helping make life-saving devices more compact and innovative, which modern medicine increasingly relies on. As medical technology advances toward minimally invasive procedures, wearable implants, and more ergonomic tools, fine wires are re-emerging as key enablers. Their unique properties of strength, flexibility, biocompatibility, and corrosion resistance make them ideal for navigating the human body safely and reliably. The global medical fine wire market was 75.95 million sq. meters in 2024 and is projected to reach 136.06 million sq. meters by 2032, growing steadily at a 6.89% CAGR. Advancements in material science, surgical technology, and connected health are fueling this growth.

Miniaturization Is Driving Market Momentum

Healthcare systems worldwide are accelerating the adoption of minimally invasive procedures (MIPs), which shorten recovery times, reduce complications, and lower costs. This shift is directly increasing demand for medical fine wires, which maintain high tensile strength, elasticity, and conductivity at micro-scale diameters. The broader minimally invasive surgery device market is projected to reach USD 55 billion by 2026, with most advances depending on wires designed for precise navigation, flexibility, and fatigue resistance, especially in cardiovascular and neurovascular procedures. Materials such as Nitinol, MP35N, stainless steel, tungsten, and platinum-iridium are increasingly tailored for specific applications rather than general use. This customization of materials is transforming how OEMs design next-generation devices.

Smart, Coated, and Multifunctional Wires Are Becoming Industry Standard

Fine wires are no longer just passive components; they have become active, functional parts of medical devices. Coatings play a crucial role in their use.

• Hydrophilic coatings for smooth vascular navigation

• Antimicrobial coatings to lower infection risks

• Drug-eluting layers, now present in 90% of coronary stents, help prevent restenosis.

• Biocompatible polymer coatings to prolong device lifespan

Manufacturers are now producing diameters as small as 0.01 mm with micron-level tolerances, which are essential for microelectrodes, cochlear implants, and pacemaker leads. Innovative technologies are further accelerating this development. Intelligent wires can transmit power or data and are becoming crucial for real-time diagnostics. The wearable medical devices market is already valued at USD 27 billion in 2024, with a 25% CAGR. This is increasing the demand for multi-core insulated wires and micro coaxial cables used in glucose monitors, neural interfaces, and implantable sensors.

Supply Chain Challenges Are Creating Strategic Tension

Despite strong demand, manufacturers encounter a significant obstacle: limited availability of specialized alloys. Only 20% of global alloy production meets medical-grade quality standards. Materials like Nitinol require vacuum induction melting and multiple remelting steps, leading to a 12–16-week lead time. For MedTech companies, this creates an urgent need to establish long-term supplier partnerships, diversify sourcing strategies, and invest in validated material alternatives.

Segment Growth: Stainless Steel Leads, Nickel Alloys Rise Fastest

The market reached USD 1,136.40 million in 2023 and is expected to grow to USD 2,027.28 million by 2032.

Key product insights include:

• Stainless steel wire was the largest segment at USD 430.86 million in 2023, and is projected to reach USD 734.57 million by 2032 with a 6.35% CAGR.

• Nickel-based alloys are projected to grow from USD 276.37 million to USD 528.05 million, with the fastest CAGR of 7.71%.

• Titanium wire is expected to increase from USD 158.13 million to USD 282.76 million, reflecting a 6.92% CAGR.

• Platinum and gold wires, valued at USD 128.46 million in 2023, are expected to grow at a 6.52% CAGR.

• Specialty alloys are projected to reach USD 259.82 million by 2032 with a CAGR of 7.11%.

This diverse material landscape opens opportunities for product differentiation and premium device development.

Asia Pacific Is Leading the Global Market

Regionally, the Asia Pacific accounted for the largest share at USD 397.74 million in 2023 and is expected to reach USD 751.97 million by 2032 (7.58% CAGR), driven by expanding healthcare infrastructure and an aging population.

North America, valued at USD 352.28 million in 2023, is projected to reach USD 629.65 million by 2032, driven by high surgical volume, established MedTech manufacturing, and robust regulatory standards.

Europe reaches USD 250.01 million in 2023 with a projected 6.83% CAGR, while MEA and Latin America grow steadily from smaller bases.

What This Means for MedTech Companies

The fine wire market is now a strategic tool for Medtech innovation rather than just a commodity space. Companies that succeed in this market will be those that:

• Integrate materials engineering early in device design

• Develop supplier resilience through multi-sourcing or vertical partnerships

• Invest in coated and innovative wire capabilities

• Leverage regional growth in Asia and North America

• Stay ahead of regulatory and quality-standard shifts

Fine wires may be small, but their role in enabling a next generation of medical devices is enormous. As minimally invasive and connected care grows, medical fine wire is becoming a key part of future healthcare and a strong opportunity for players across the Medtech supply chain.