Top 10 Electric Vehicle Motor Manufacturers by Production Volume: Market Leaders Driving the EV Revolution

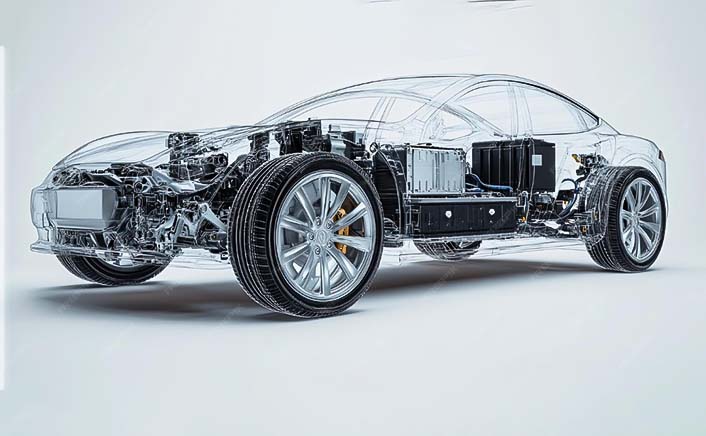

Electric vehicle (EV) motors are central to the worldwide move toward electrification. As the adoption of EVs grows among passenger cars, commercial vehicles, and two-wheelers, the need for efficient, large-scale electric motors has increased significantly. While batteries tend to receive more focus, motors are the crucial components that convert electrical energy into motion. Producing motors at scale has become a vital competitive edge.

Global EV motor manufacturing is becoming more centralized among various automotive OEMs and Tier-1 suppliers. Many of these companies are vertically integrating motor production to manage costs better, boost efficiency, and ensure a secure supply chain. Below are the leading electric vehicle motor producers, ranked by production volume, including installed base, OEM output, and supply scale.

1. BYD

BYD is widely regarded as the world’s largest EV motor producer by volume. Its strength lies in deep vertical integration, including in-house motor, power electronics, and battery manufacturing. BYD produces motors not only for passenger EVs but also for buses, trucks, and commercial fleets, giving it unmatched scale across vehicle categories.

2. Tesla

Tesla is one of the few automakers that designs and manufactures motors entirely in-house at scale. Its permanent magnet and induction motor platforms are produced across facilities in the U.S., China, and Europe. High vehicle output combined with proprietary motor designs places Tesla among the top global producers by unit volume.

3. Bosch

Bosch is a leading supplier of electric drive systems, supplying motors to multiple global OEMs. Its strength lies in high-volume production for mass-market passenger vehicles and light commercial EVs. Bosch’s scalable motor platforms and strong OEM relationships underpin its high production volumes.

4. Nidec

Nidec is a pure-play motor specialist and one of the world’s largest electric motor manufacturers overall. In the EV space, it supplies traction motors to a wide range of automakers, particularly in Asia. Its focus on standardized, high-speed motor designs enables cost-efficient mass production.

5. Volkswagen Group

Volkswagen Group has rapidly expanded in-house motor production to support its EV platform strategy. Through its modular electric drive systems, the group produces motors for multiple brands, including Volkswagen, Audi, and Škoda. High vehicle output across Europe and China drives significant motor volumes.

6. Toyota

Toyota leverages decades of hybrid motor experience to scale EV motor production. While historically focused on hybrids, Toyota’s expanding battery-electric vehicle portfolio is increasing motor output, supported by strong internal manufacturing capabilities and supplier integration.

7. Hyundai Motor Group

Hyundai Motor Group produces electric motors internally for its Hyundai, Kia, and Genesis EV models. Its production scale is supported by strong EV sales growth in Asia, Europe, and North America, with a focus on efficiency-optimized motor architectures.

8. ZF

ZF is a major Tier-1 supplier of electric drivetrains, including passenger-car and commercial-vehicle motors. Its modular e-drive platforms enable OEMs to scale quickly, driving high production volumes across multiple vehicle segments.

9. Hitachi Astemo

Hitachi Astemo supplies electric motors and integrated drive units to several global automakers. Its focus on efficiency, reliability, and integration with power electronics supports steady volume growth, particularly in Asia.

10. Magna International

Magna International has emerged as a key EV motor supplier through its scalable e-drive systems. Serving multiple OEMs across regions, Magna benefits from diversified demand and growing EV program launches, supporting increasing production volumes.

What This Ranking Indicates

Leadership in EV motor production increasingly hinges on vertical integration, scalable platforms, and OEM collaborations. Automakers who produce motors in-house enjoy better cost control and greater design flexibility, whereas Tier-1 suppliers benefit from supplying multiple OEMs at once.

As EV sales grow, motor manufacturers that can produce high-efficiency motors at a mass-market scale are poised to lead future growth. The market is becoming more specialized, with motors tailored for passenger EVs, commercial vehicles, and performance uses.

Looking Ahead

As global EV sales are projected to grow at double-digit rates, electric motor production will similarly increase. Manufacturers that invest in advanced materials, higher power density, and automated production processes will be best positioned to meet the upcoming surge in demand.

This list shows the current production leadership, but rapid capacity growth, especially in China, Europe, and North America, means competitive standings will continue to change over the next few years.

No FAQs available at the moment.