How Environmental Regulations Are Shaping the Future of Wet Etching in Europe’s High-Tech Manufacturing

"The European wet etchants market is experiencing consistent growth, spurred by the increasing demand from key sectors such as semiconductors, photovoltaics, and MEMS manufacturing. This growth is largely influenced by the miniaturization trend in electronic components and a rise in renewable energy projects, particularly in solar panel production, which relies on wet etching during wafer fabrication. Leading countries like Germany, France, and the Netherlands are at the forefront of innovation and investment in cleanroom technologies and microfabrication, driving the consumption of wet etchants, including hydrofluoric acid, nitric acid, and phosphoric acid. The market is also supported by the push for 5G infrastructure and advancements in automotive electronics, both of which require precise etching methods.

However, the industry faces challenges due to stringent environmental and safety regulations in the EU regarding the handling and disposal of hazardous chemicals. As a result, manufacturers are increasingly investing in safer and more eco-friendly alternatives, prompting a shift in supply strategies. Additionally, collaboration among established semiconductor fabs and research institutions promotes innovation and product development. There is a growing trend toward strategic partnerships and regional sourcing to lessen reliance on global supply chains. Overall, analysts see the European wet etchants market as a stable sector with moderate growth driven by technological advancements and changing environmental compliance requirements."

The Europe Wet Etchants market was valued at USD 167 Million in 2024 and is projected to reach USD 254 Million by 2030, with a compound annual growth rate (CAGR) of 6.2% from 2025 to 2030.

Additionally, Europe's commitment to digital sovereignty and the EU's CHIPS Act are encouraging domestic semiconductor production, which further contributes to market growth. The presence of key industry players and technology innovation hubs also fosters the rapid development of high-precision etching processes. Moreover, stricter environmental regulations are pushing manufacturers to adopt cleaner and more efficient wet etching chemistries, prompting innovation in eco-friendly formulations.

With a strategic focus on sustainable electronics manufacturing and advanced materials processing, Europe is well-positioned to continue its strong growth trajectory in the global wet etchants market in the coming years.

In an effort to lessen its reliance on Asian suppliers, Europe is increasing its local chip production with the help of programs like the EU CHIPS Act.

Europe is making significant progress in enhancing its semiconductor manufacturing capabilities to reduce reliance on Asia and ensure a more resilient supply chain. This effort is largely fueled by the EU CHIPS Act, which aims to double Europe’s share of the global semiconductor market to 20% by 2030. The European Union is investing billions of euros into domestic chip production to support both established manufacturers and new startups. Countries like Germany, the Netherlands, and France are at the forefront of this movement, with new fabrication plants being planned or constructed.

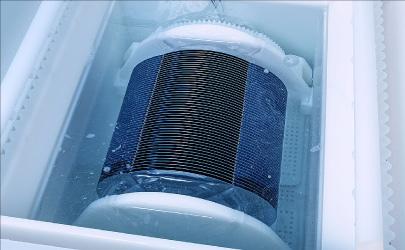

As these new facilities come online, there's a growing demand for wet etching chemicals, which are essential in processes like photolithography and wafer cleaning in semiconductor production. With chip designs becoming increasingly compact and complex, there’s also a rising need for high-purity and precision etchants. The integration of technologies such as AI, cloud computing, and quantum computing into European industrial strategies has further created opportunities for advanced chip development.

This surge in semiconductor manufacturing not only drives demand for wet etchants but also attracts investments in related technologies like cleanrooms, chemical delivery systems, and waste treatment solutions. As a result, Europe is developing a robust ecosystem where wet etchants play a critical role in this semiconductor renaissance.

The growing demand for advanced driver-assistance systems (ADAS) and electric vehicles (EVs) is increasing the need for semiconductor components, driving wet etchant usage.

Europe's renowned automotive industry plays a vital role in driving demand for wet etchants, largely due to the increasing integration of electronics into vehicles. Countries like Germany, France, and Italy are home to leading automotive manufacturers such as Volkswagen, BMW, Daimler, Stellantis, and Renault. The shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) has significantly increased the reliance on high-performance chips and sensors. These components require miniaturization and high precision, achievable through advanced wet etching processes.

Wet etchants are crucial for creating fine circuitry on semiconductor wafers that power essential automotive systems, including collision detection, lane departure warnings, infotainment systems, and battery management units. Furthermore, as vehicles advance towards autonomous operation, the demand for more complex sensor and computing systems continues to grow.

Europe's commitment to leading in green transportation and its goal of phasing out new combustion engine vehicle sales by 2035 further enhances the demand for EV components, thereby increasing the consumption of wet etching chemicals. The interplay between Europe's automotive innovation and semiconductor needs positions wet etchants at the heart of this technological evolution, creating strong growth opportunities for the market.

Countries like Germany, the Netherlands, and France are home to leading research institutions and fabrication labs, promoting innovation in microfabrication processes.

Europe's extensive network of research institutions, universities, and innovation hubs serves as a crucial driver for the wet etchants market. Countries such as Germany, the Netherlands, France, and Switzerland host world-class institutions like IMEC (Belgium), the Fraunhofer Society (Germany), and CEA-Leti (France), all of which are actively engaged in research and development in microelectronics and nanotechnology. These institutions are key contributors to the advancement of next-generation semiconductor technologies, often necessitating sophisticated etching techniques for prototyping and testing.

Wet etchants are essential in these research environments due to their versatility, controllability, and compatibility with emerging materials. Additionally, innovation districts and public-private partnerships across Europe facilitate early-stage fabrication and pilot production utilizing wet etching. These settings are critical for validating new chip architectures, micro-electromechanical systems (MEMS), photonic devices, and flexible electronics—all of which depend on precision etching.

Furthermore, the EU's Horizon Europe funding program encourages research and development in sustainable manufacturing and advanced electronics, which indirectly increases demand for cutting-edge wet etching solutions. This strong focus on innovation not only promotes continuous technological advancement but also supports the commercialization of wet etching chemistry, providing Europe with a competitive advantage in precision fabrication and semiconductor technology development.

Stringent EU environmental regulations are encouraging the adoption of eco-friendly wet etchants, spurring demand for new formulations.

Europe is a global leader in enforcing strict environmental regulations, especially regarding the use of hazardous chemicals in manufacturing. This focus on sustainability significantly impacts the wet etchants market. Traditional etching chemicals, like hydrofluoric acid, present environmental and health risks, prompting both regulators and manufacturers to seek eco-friendly alternatives. In response, European companies are developing low-toxicity, biodegradable, and recyclable wet etchants that comply with REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) and other EU directives.

These innovations are being rapidly adopted in semiconductor fabs and R&D labs that aim to meet sustainability targets without sacrificing performance. Additionally, circular economy practices, such as chemical recycling and wastewater treatment, are being integrated into wet etching processes to minimize environmental impact.

These sustainability demands are creating new market opportunities for specialty chemical suppliers to offer green formulations and closed-loop systems. Furthermore, the pressure from consumers and governments in Europe for greener supply chains is encouraging end-users—particularly in the electronics and automotive sectors—to choose etching solutions that have a reduced environmental footprint. Consequently, companies investing in sustainable wet etching technologies not only ensure compliance but also improve their competitive position in the European market.

The proliferation of smart devices and 5G infrastructure is increasing the need for high-performance chips, boosting the wet etching process.

The rapid deployment of 5G infrastructure and the expansion of the Internet of Things (IoT) ecosystem across Europe are significant drivers of growth for the wet etchants market. Both technologies necessitate the fabrication of a wide range of advanced semiconductor devices that offer enhanced functionality and smaller form factors.

Wet etching plays a crucial role in producing high-density integrated circuits (ICs), sensors, and radio frequency (RF) components needed for IoT nodes and 5G base stations. As industries and consumers increasingly adopt smart solutions—ranging from wearable health monitors to smart homes and industrial automation—the demand for microelectronics in Europe is booming. Countries such as Germany, the UK, and Sweden are leading the way in 5G rollouts and smart infrastructure initiatives.

These projects heavily rely on backend semiconductor processes, where wet etching is essential for patterning, cleaning, and surface modification. Additionally, the miniaturization of electronics for portable IoT applications requires etching techniques that deliver high precision and low defect rates—advantages that wet etchants offer. As 5G networks expand and the number of connected devices continues to rise, the need for high-throughput and cost-effective etching solutions will persist, establishing wet etchants as a cornerstone in Europe’s digital infrastructure development.

Competitive Landscape

Some of the major companies operating within the Wet Etchants market are: BASF, Stella Chemifa, Honeywell, FDAC, Solvay, Avantor, Mitsubishi Chemical, ENF Technology, Xingfa Group and Others.